How to Build an Emergency Fund in 2026 (Even If You're Starting From Zero)

57% of Americans can't cover a $1,000 emergency. Here's a practical, no-BS guide to building your financial safety net in 2026 — whether you're starting with $0 or just getting serious about savings.

John Mitchell

CFP®, CFA

Let me be direct with you: if you don't have an emergency fund, you're one bad month away from financial disaster. A job loss, a medical bill, a car breakdown — any of these can spiral into credit card debt, missed rent, or worse.

I've spent 15 years writing about personal finance, and I can tell you the single most important thing you can do for your financial health isn't picking the right stocks or finding the best credit card. It's having cash set aside for when life punches you in the face.

And life will punch you in the face.

The Reality Check

According to Bankrate's 2024 Emergency Savings Report, 57% of Americans can't cover a $1,000 unexpected expense from savings. That's not a typo — more than half the country is living on the edge.

But here's what frustrates me about most "build an emergency fund" advice: it assumes you have money lying around. "Just save 3-6 months of expenses!" Great. With what?

This guide is for people starting from zero. Or close to it.

How Much Do You Actually Need?

The standard advice is 3-6 months of essential expenses. But let's be realistic about what that means:

Essential expenses include:

- Rent/mortgage

- Utilities

- Food (groceries, not restaurants)

- Insurance premiums

- Minimum debt payments

- Transportation to work

Essential expenses don't include:

- Netflix

- Gym memberships

- Dining out

- Shopping

For most Americans, essential monthly expenses run between $2,500 and $4,500. That means a full emergency fund is somewhere between $7,500 and $27,000.

If that number makes you want to close this tab, hold on. We're going to break this down into actually achievable steps.

The Starter Fund: Your First $1,000

Forget 3-6 months for now. Your first goal is $1,000. This covers most common emergencies:

- Car repairs (average: $500-$600)

- Medical copays

- Emergency travel

- Appliance replacement

$1,000 won't solve everything, but it'll keep most emergencies from becoming catastrophes.

How to Get Your First $1,000

1. Sell something this week

Look around your home. Old electronics, clothes you don't wear, furniture you don't use. Facebook Marketplace, eBay, Poshmark — pick one and list 10 items today. Average American household has $3,000+ in unused items.

2. Cut one subscription temporarily

Not forever — just until you hit $1,000. That streaming service you barely use? Cancel it. Put the $15/month toward your fund.

3. Automate $25/week

Set up automatic transfers from checking to savings every payday. $25/week = $1,300/year. You'll hit $1,000 in 10 months without thinking about it.

4. Redirect one windfall

Tax refund? Birthday money? Work bonus? Before you spend it, move it to savings. This year, the average tax refund is around $3,000. That's your entire starter fund right there.

Building the Full Fund: 3-6 Months

Once you've got $1,000, it's time to build the real safety net. This is a marathon, not a sprint.

Calculate Your Target

- List your essential monthly expenses (use last month's bank statement)

- Multiply by 3 (if you have a stable job with good job security)

- Multiply by 6 (if you're self-employed, work in a volatile industry, or have dependents)

The Strategy

Treat it like a bill. Your emergency fund contribution isn't optional — it's a fixed expense like rent. Pay yourself first.

Use a separate account. Keep your emergency fund in a high-yield savings account at a different bank than your checking. Make it slightly inconvenient to access. Out of sight, out of mind.

Current high-yield savings rates: As of early 2026, the best high-yield savings accounts are paying 4.5-5% APY. That's free money. If you're keeping your emergency fund in a regular savings account earning 0.01%, you're leaving hundreds of dollars on the table.

Timeline Expectations

Let's say your target is $15,000 (about 4 months of expenses for the median household).

- Saving $500/month = 30 months (2.5 years)

- Saving $750/month = 20 months

- Saving $1,000/month = 15 months

Yeah, it takes a while. That's okay. Progress beats perfection.

Where to Keep Your Emergency Fund

Your emergency fund needs to be:

- Liquid — accessible within 1-2 days

- Safe — FDIC insured, not invested in stocks

- Earning interest — because inflation is real

Best options:

- High-yield savings accounts (Marcus, Ally, Discover)

- Money market accounts

- Treasury bills (for larger funds)

Worst options:

- Regular checking account (no interest)

- Under your mattress (inflation eats it)

- Invested in stocks (too volatile)

- CDs (penalty for early withdrawal defeats the purpose)

What Counts as an Emergency?

This is where people screw up. An emergency is:

- Job loss

- Medical emergency

- Essential car repairs

- Urgent home repairs (burst pipe, broken furnace)

- Emergency travel for family crisis

An emergency is NOT:

- A vacation deal

- A sale on something you want

- Holiday shopping

- A new phone because yours is "old"

- Concert tickets

Be honest with yourself. If you raid your emergency fund for non-emergencies, you're just saving in a different account — not building security.

The Bottom Line

Building an emergency fund isn't exciting. It won't make you rich. Nobody's going to congratulate you on Instagram for having 4 months of expenses in a savings account.

But when the unexpected happens — and it will — you'll have options instead of panic. You'll have breathing room instead of credit card debt. You'll have peace of mind instead of 3 AM anxiety about how you're going to pay the bills.

Start today. Not Monday. Not next month. Today.

$25 into a savings account. That's it. That's the first step.

Have questions about building your emergency fund? Drop them in the comments below.

Continue Reading

More from Budgeting

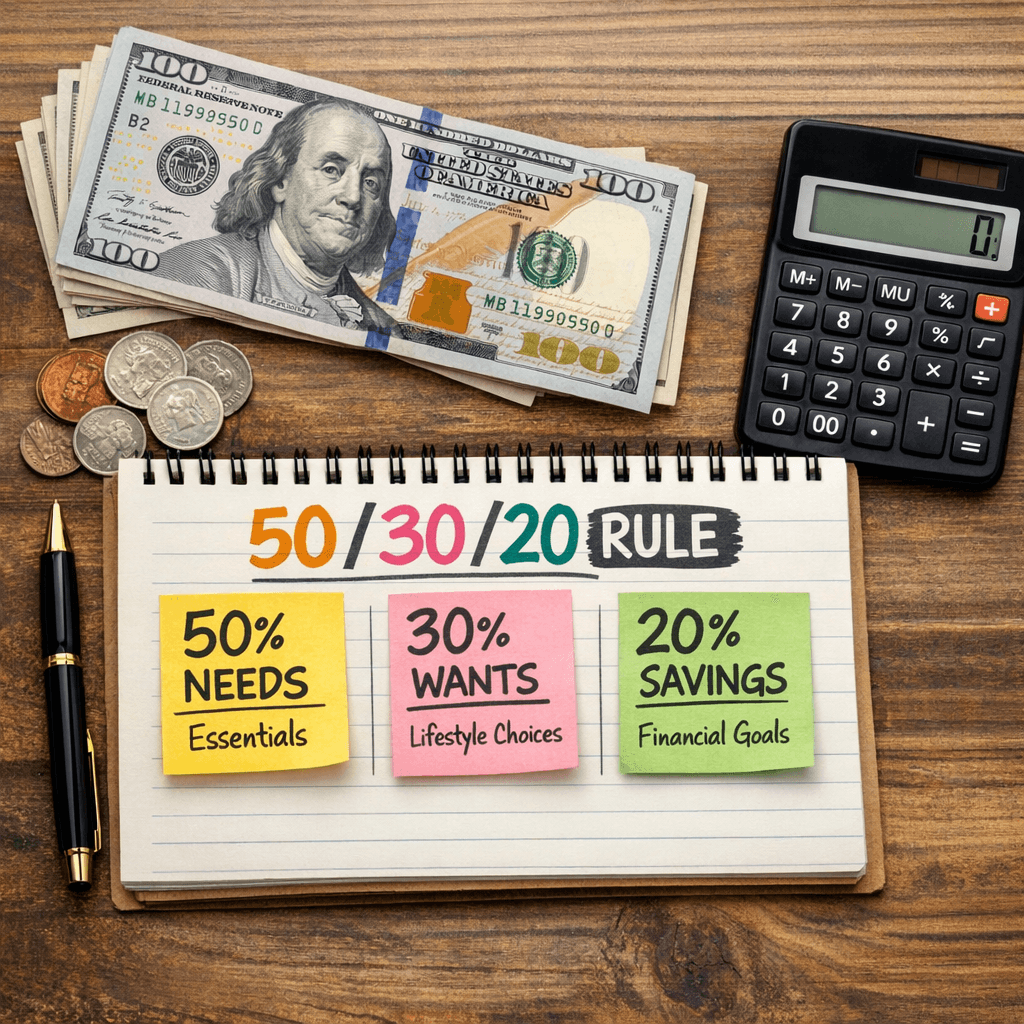

Budgeting

BudgetingThe 50/30/20 Budget Rule Explained (And How to Actually Use It)

The 50/30/20 rule is the simplest budgeting framework that actually works. Here's what it means, how to apply it to your income, and when you might need to adjust it.

You May Also Find Interesting

Crypto

CryptoBitcoin for Beginners: What You Need to Know in 2026

Curious about Bitcoin but confused by the jargon? Here's a plain-English guide to what Bitcoin is, how it works, and whether it belongs in your portfolio.

Real Estate

Real EstateRent vs. Buy in 2026: The Math That Actually Matters

Should you rent or buy a home in 2026? Forget the emotional arguments. Here's the actual financial math to help you make the right decision for your situation.

Retirement

Retirement401(k) Basics: Everything You Need to Know in 2026

Your employer offers a 401(k). Should you use it? How much should you contribute? What's a match? Here's the complete beginner's guide to the retirement account that could make you a millionaire.

Credit

CreditWhat's a Good Credit Score? The Numbers That Actually Matter in 2026

Your credit score affects everything from mortgage rates to job applications. But what's actually "good"? Here's what the numbers mean and what lenders really look for in 2026.