Bitcoin for Beginners: What You Need to Know in 2026

Curious about Bitcoin but confused by the jargon? Here's a plain-English guide to what Bitcoin is, how it works, and whether it belongs in your portfolio.

John Mitchell

CFP®, CFA

Bitcoin has gone from obscure internet money to a $2 trillion asset class. Major financial institutions own it. Countries have adopted it as legal tender. The SEC approved Bitcoin ETFs.

And yet, most people still don't really understand what it is.

If you're curious but confused, this guide is for you. No crypto-bro hype. No technical jargon. Just the facts.

What Is Bitcoin?

Bitcoin is digital money that exists without any central authority — no government, no bank, no company controls it.

Created in 2009 by the pseudonymous Satoshi Nakamoto, Bitcoin runs on a decentralized network of computers around the world. Transactions are verified by this network and recorded on a public ledger called the blockchain.

Key properties:

- Limited supply: Only 21 million Bitcoin will ever exist (about 19.5 million have been mined so far)

- Decentralized: No single entity controls it

- Borderless: Can be sent anywhere in the world, 24/7

- Transparent: All transactions are publicly viewable

- Irreversible: Once confirmed, transactions can't be undone

How Does Bitcoin Work?

Without getting too technical:

-

Wallets: You store Bitcoin in a digital wallet (an app or hardware device). Your wallet has a public address (like an account number) and a private key (like a password).

-

Transactions: When you send Bitcoin, you broadcast the transaction to the network. Miners (computers running specialized software) verify the transaction.

-

Blockchain: Verified transactions are bundled into "blocks" and added to the chain. Each block references the previous one, creating an unbreakable record.

-

Mining: Miners compete to solve complex math problems. The winner gets to add the next block and receives newly created Bitcoin as a reward. This is how new Bitcoin enters circulation.

The whole system runs without any central coordinator. That's the innovation.

Why Does Bitcoin Have Value?

This is the question skeptics always ask. Here's the honest answer:

Bitcoin has value because people agree it has value — the same reason the US dollar, gold, or collectible art has value.

But there are specific properties that make people value it:

Scarcity: With only 21 million ever to exist, Bitcoin is mathematically scarce. You can't print more.

Durability: It doesn't degrade like physical assets.

Portability: You can carry billions of dollars worth across borders in your head (memorize the seed phrase).

Divisibility: One Bitcoin can be divided into 100 million "satoshis." You can buy $10 worth.

Censorship resistance: No government can freeze your Bitcoin if you control your own keys.

Is this enough to justify the current price? That's the trillion-dollar debate.

Bitcoin in 2026: What's Changed

Bitcoin has matured significantly:

Spot Bitcoin ETFs: The SEC approved Bitcoin ETFs in January 2024. Now you can buy Bitcoin exposure through Fidelity, BlackRock, and other major brokerages — no crypto wallet needed.

Institutional adoption: Major corporations and investment funds hold Bitcoin on their balance sheets.

Regulatory clarity: The US and other countries have established clearer frameworks (though it varies by jurisdiction).

The halving: In April 2024, the Bitcoin mining reward was cut in half (from 6.25 to 3.125 BTC per block). This happens every four years and historically precedes bull markets.

Price: Bitcoin has seen significant volatility but has trended upward over the long term. Past performance doesn't guarantee future results.

Should You Buy Bitcoin?

Here's my honest take:

Bitcoin might make sense if:

- You have a long time horizon (5+ years minimum)

- You've already maxed out tax-advantaged retirement accounts

- You can afford to lose 100% of what you invest

- You understand it's highly volatile

- You believe in the thesis (digital scarcity, hedge against currency debasement)

Bitcoin probably doesn't make sense if:

- You don't have an emergency fund

- You have high-interest debt

- You need the money within 5 years

- You'll panic sell during a 50% crash

- You're just buying because of FOMO

My position: I'm not a Bitcoin maximalist, but I think a small allocation (1-5% of portfolio) is reasonable for people who understand the risks. It's asymmetric — you can lose 100%, but the upside potential is significant.

This is not a recommendation to buy. Do your own research.

How to Buy Bitcoin

Option 1: Bitcoin ETFs (Easiest)

If you just want price exposure without dealing with wallets and keys:

- iShares Bitcoin Trust (IBIT)

- Fidelity Wise Origin Bitcoin Fund (FBTC)

- ARK 21Shares Bitcoin ETF (ARKB)

Buy through your regular brokerage (Fidelity, Schwab, etc.) like any stock.

Pros: Simple, familiar, can hold in IRA Cons: Annual fees (0.2-0.25%), you don't actually own Bitcoin

Option 2: Crypto Exchanges

To own actual Bitcoin:

- Coinbase (most beginner-friendly, US-regulated)

- Kraken (lower fees, good reputation)

- Cash App (simple for small amounts)

Pros: You own real Bitcoin, can withdraw to your own wallet Cons: Need to learn about wallets and security

Option 3: Self-Custody

For maximum security and control, withdraw your Bitcoin to a hardware wallet (Ledger, Trezor). You control the private keys.

Pros: True ownership, censorship-resistant Cons: Steep learning curve, you're responsible for security

Bitcoin Security Basics

If you hold Bitcoin on an exchange, you're trusting that exchange not to get hacked or go bankrupt (see: FTX).

If you want to truly own your Bitcoin, learn these concepts:

Private key: A secret code that controls your Bitcoin. Never share it. Ever.

Seed phrase: 12-24 words that can recover your wallet. Write it down on paper. Store it securely (fireproof safe, bank deposit box). Never store it digitally.

Not your keys, not your coins: If you don't control the private keys, you don't truly own the Bitcoin. The exchange does.

Common Bitcoin Mistakes

Investing more than you can lose Bitcoin can drop 50-80% and has done so multiple times. Only invest money you won't need for years.

Trading instead of holding Trying to time the market usually leads to buying high and selling low. Most successful Bitcoin investors simply bought and held.

Falling for scams No one legitimate will ask you to send Bitcoin to "double it" or "verify your wallet." All such requests are scams.

Losing your seed phrase If you lose access to your wallet and don't have the seed phrase, your Bitcoin is gone forever. No customer support can help you.

Keeping everything on exchanges Exchanges get hacked. They go bankrupt. If you hold significant amounts, learn self-custody.

Bitcoin vs. Other Cryptocurrencies

Bitcoin is the original cryptocurrency and remains the largest by market cap. But there are thousands of others:

Ethereum (ETH): Smart contract platform, enables DeFi and NFTs. More like a "world computer" than digital money.

Stablecoins (USDC, USDT): Pegged to the US dollar. Used for trading and transfers, not as investments.

Altcoins: Everything else. Most will go to zero. Some might 100x. It's mostly speculation.

My take: If you're new to crypto, start with Bitcoin. It has the longest track record, most liquidity, and clearest use case. You can explore altcoins later if you choose.

The Bottom Line

Bitcoin is a fascinating experiment in digital scarcity and decentralized money. It might be the future of finance. It might be a speculative bubble. Probably some of both.

If you decide to buy:

- Only invest what you can afford to lose

- Start small (1-5% of portfolio max)

- Use a reputable exchange or ETF

- Think long-term (5+ years)

- Learn about self-custody if you hold significant amounts

- Ignore the noise and don't panic sell

Bitcoin rewards patience and punishes panic. Know what you own and why you own it.

Questions about Bitcoin or crypto? Drop them in the comments — I'll give you the straight answer.

You May Also Find Interesting

Budgeting

BudgetingHow to Build an Emergency Fund in 2026 (Even If You're Starting From Zero)

57% of Americans can't cover a $1,000 emergency. Here's a practical, no-BS guide to building your financial safety net in 2026 — whether you're starting with $0 or just getting serious about savings.

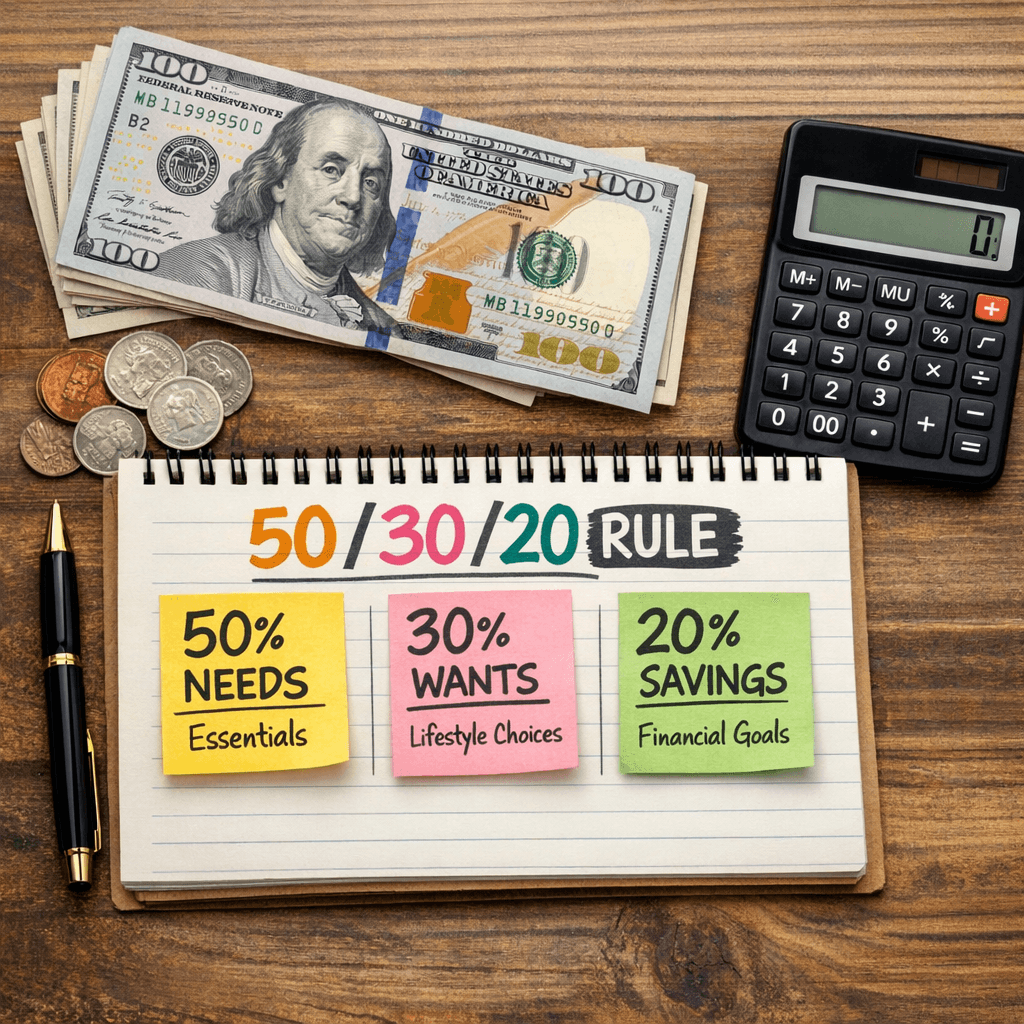

Budgeting

BudgetingThe 50/30/20 Budget Rule Explained (And How to Actually Use It)

The 50/30/20 rule is the simplest budgeting framework that actually works. Here's what it means, how to apply it to your income, and when you might need to adjust it.

Real Estate

Real EstateRent vs. Buy in 2026: The Math That Actually Matters

Should you rent or buy a home in 2026? Forget the emotional arguments. Here's the actual financial math to help you make the right decision for your situation.

Retirement

Retirement401(k) Basics: Everything You Need to Know in 2026

Your employer offers a 401(k). Should you use it? How much should you contribute? What's a match? Here's the complete beginner's guide to the retirement account that could make you a millionaire.